south dakota property tax records

Register for Instant Access to Our Database of Nationwide Foreclosure Listings. Property assessments are public information.

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

This office is a storage facility for a host of local documents.

. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. Determining tax exempt status for applicable properties. They are maintained by.

Determining the taxable value of approximately 25000 parcels. This value is reflected to the. Tax amount varies by county.

Property Tax Assessment Process. A South Dakota Property Records Search locates real estate documents related to property in SD. They are maintained by.

Belle Fourche SD 57717. State Summary Tax Assessors. Up to 38 cash back Property Tax Records.

104 N Main Street. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. 2021 payable 2022 property taxes are now available.

Payments can be mailed to Pennington County Treasurer PO Box 6160 Rapid City SD 57709. Use our free South Dakota property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent. Ad South Public Records Search Free - Start With Just A Name State.

Email the Treasurers Office. Please call the Treasurers Office. Any person may review the property assessment of any property in South Dakota.

Taxes in South Dakota are due and payable the first of January however the first half of property tax payments are accepted until April 30 without penalty. The county register of deeds office can most appropriately be thought of as a library of local records. South Dakota real and personal property tax records are managed by the County Assessor office in each county.

Ad Find Out the Market Value of Any Property and Past Sale Prices. Continuing to educate the public on the South Dakota tax system. Public Property Records provide information on land homes and commercial properties.

South Dakota law requires the equalization office to appraise property at its full and true value as of November 1 of each year. If you are unable to visit our office a last document search request may be made by email or phone and will be. If your taxes are delinquent you will not be able to pay online.

South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. The Mount Rushmore State. First ½ becomes delinquent on May 1 2022.

South Dakota Public Records. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. 128 of home value.

An individual will receive instructions and assistance on the Index books. The Property Tax Division is responsible for overseeing South Dakotas property tax system including property tax assessments property tax levies and all property tax laws. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

To 5 pm Monday - Friday. Convenience fees 235 and will appear on your credit card statement as a separate charge. Nevada New Hampshire New Jersey New Mexico New York North Carolina.

View 161 Dakota Shores Place White South Dakota 57276 property records for FREE including property ownership deeds mortgages titles sales history current historic tax. The second half of property tax. ViewPay Property Taxes Online.

Please notate ID wishing to pay. About Assessor and Property Tax Records in South Dakota. The Pennington County Equalization Department maintains an.

The South Dakota Property Tax Division maintains information on property taxes including real property taxes in South Dakota. Ad Search All of the Most Up-to-Date Foreclosure Listings Available Near You.

Tax Information In Tea South Dakota City Of Tea

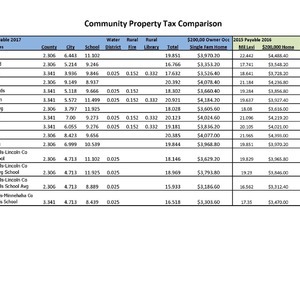

North Dakota Property Tax Calculator Smartasset

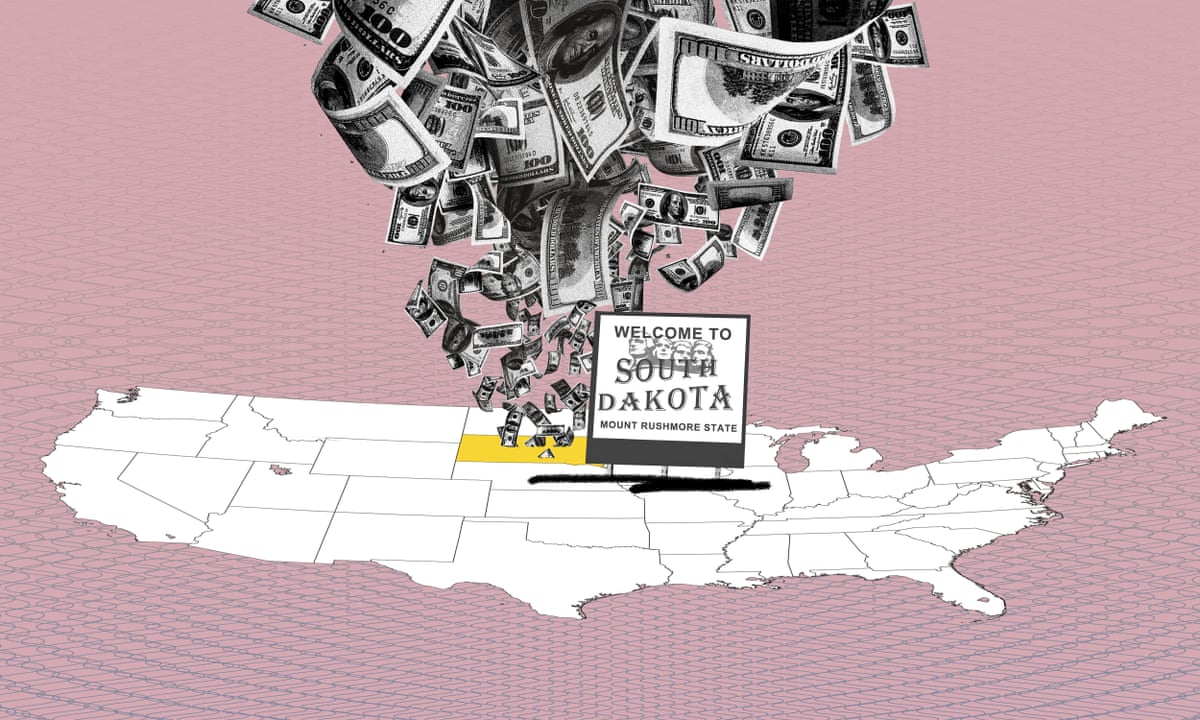

Pandora Papers Reveal South Dakota S Role As 367bn Tax Haven Us News The Guardian

Property Tax South Dakota Department Of Revenue

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Hennepin County Mn Property Tax Calculator Smartasset

Assessment Freeze For The Elderly Disabled South Dakota Department Of Revenue

Tax Information In Tea South Dakota City Of Tea

Property Tax South Dakota Department Of Revenue

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

South Dakota Parcel Data Search Land Assessments In Sd

Property Tax South Dakota Department Of Revenue

Property Tax South Dakota Department Of Revenue

2022 Property Taxes By State Report Propertyshark

Property Tax South Dakota Department Of Revenue

Understanding Your Property Tax Statement Cass County Nd

Property Assessment Oglala Lakota County South Dakota